Don't Start from Scratch.

Start with Cognigy.

Accelerate your time to value with ready-made Agentic AI Agents for banking including built-in industry specific templates, terms and flows.

Transform customer engagement with fully pre-trained AI Agents

Explore Enterprise AI Agents

AI Agent Manager

Visual AI Agent creation and orchestration engine

Agentic AI

Autonomous, goal-oriented AI Workforce powered by LLMs

Voice Gateway

Turnkey voice connectivity to any contact center

Generative AI

Enterprise-ready LLMs for CX transformation

Knowledge AI

AI-based semantic search and knowledge management

NLU

Market-leading AI for 100+ languages

Multimodal CX

Cross-channel customer journeys with xApps

.png?width=60&height=60&name=AI%20Copilot%20logo%20(mega%20menu).png)

Agent Copilot

Next-gen agent assist for enterprise contact centers

Live Chat

AI-powered Live Agent workspace

Insights

Omnichannel reporting and analytics suite

Downloads

Guides, white papers, analyst reports and more

Blog

Stay in the loop on everything CX and CAI

Resources

Learn how to power up your contact center

Cognigy Academy

Become a certified expert with on-demand courses

Showcase Shorts

Explore the art of the possible in short videos demonstrating CAI

CX Disruptors

Insights from leading voices in the customer service industry

eBook: Blueprint for an AI-First Contact Center

Download noweBook: Generative AI for Contact Centers

Download nowWebinar: Generative AI and Cognigy in the Contact Center

Watch nowAbout Us

Join our mission to make Conversational AI more accessible

Our Partners

Dive into our global ecosystem of leading business and technology partners

Events

Find us at live conferences or virtual meetups

Careers

Help us achieve our vision with your talents and skills

News & Announcements

Be the first to know about all the latest news

Nexus

The Most Important Contact Center AI Summit

Contact Us

Reach out to our experts and get your questions answered

Cognigy Trust Center

See how we help your organization secure sensitive data and comply with applicable laws and regulations.

Read MoreThe Future of Enterprise-Grade AI Adoption

An in-depth guide into the trusted use of AI in customer service automation

Read MoreCognigy.AI is officially AIC4-approved

Find out everything you need to know about establishing "Explainable AI" based on the AIC4 criteria catalogue.

Read MoreAI Agent Manager

Visual AI Agent creation and orchestration engine

Agentic AI

Autonomous, goal-oriented AI Workforce powered by LLMs

Voice Gateway

Turnkey voice connectivity to any contact center

Generative AI

Enterprise-ready LLMs for CX transformation

Knowledge AI

AI-based semantic search and knowledge management

NLU

Market-leading AI for 100+ languages

Multimodal CX

Cross-channel customer journeys with xApps

.png?width=60&height=60&name=AI%20Copilot%20logo%20(mega%20menu).png)

Agent Copilot

Next-gen agent assist for enterprise contact centers

Live Chat

AI-powered Live Agent workspace

Insights

Omnichannel reporting and analytics suite

Downloads

Guides, white papers, analyst reports and more

Blog

Stay in the loop on everything CX and CAI

Resources

Learn how to power up your contact center

Cognigy Academy

Become a certified expert with on-demand courses

Showcase Shorts

Explore the art of the possible in short videos demonstrating CAI

CX Disruptors

Insights from leading voices in the customer service industry

eBook: Blueprint for an AI-First Contact Center

Download noweBook: Generative AI for Contact Centers

Download nowWebinar: Generative AI and Cognigy in the Contact Center

Watch nowAbout Us

Join our mission to make Conversational AI more accessible

Our Partners

Dive into our global ecosystem of leading business and technology partners

Events

Find us at live conferences or virtual meetups

Careers

Help us achieve our vision with your talents and skills

News & Announcements

Be the first to know about all the latest news

Nexus

The Most Important Contact Center AI Summit

Contact Us

Reach out to our experts and get your questions answered

Cognigy Trust Center

See how we help your organization secure sensitive data and comply with applicable laws and regulations.

Read MoreThe Future of Enterprise-Grade AI Adoption

An in-depth guide into the trusted use of AI in customer service automation

Read MoreCognigy.AI is officially AIC4-approved

Find out everything you need to know about establishing "Explainable AI" based on the AIC4 criteria catalogue.

Read Morefaster response time

increased net promoter score (NPS)

lower AHT

savings in After Call Work

Accelerate your time to value with ready-made Agentic AI Agents for banking including built-in industry specific templates, terms and flows.

Pre-trained intents and flows speed up design and deployment. Our solution accelerator covers a range of scenarios from account type comparison, credit card applications, loan and mortgage processes and more.

Prebuilt lexicons with common terms, phrases and services for banks and financial services companies.

Automate common service processes such as freezing a card, reporting travel, checking your balance, account updates, ordering a new card and more.

Agentic AI Agents help both customers and customer service representatives.

AI agents for banking provide instant, personalized service using customer data and conversation context to deliver real-time, contextual recommendations and solutions. They support any voice or digital channel and are available 24/7.

Reduce operational costs by partially or fully automating repetitive tasks and processes with AI Agents while providing real-time agent assistance.

Higher containment rates and faster, accurate agents reduce handling times and increase FCR while reducing training times and agent turnover.

.png?width=839&height=547&name=Agentic%20AI%20Graphics%20(2).png)

Security and compliance are not optional and Cognigy's AI Agents are designed to both protect you and your customers.

They comply with GDPR, SOC2 Type II, ISO 27001, ISO9001, PCI DSS and more.

%202024/8000x8000/cognigy-illustration-banking-and-finance.jpg?width=500&height=500&name=cognigy-illustration-banking-and-finance.jpg)

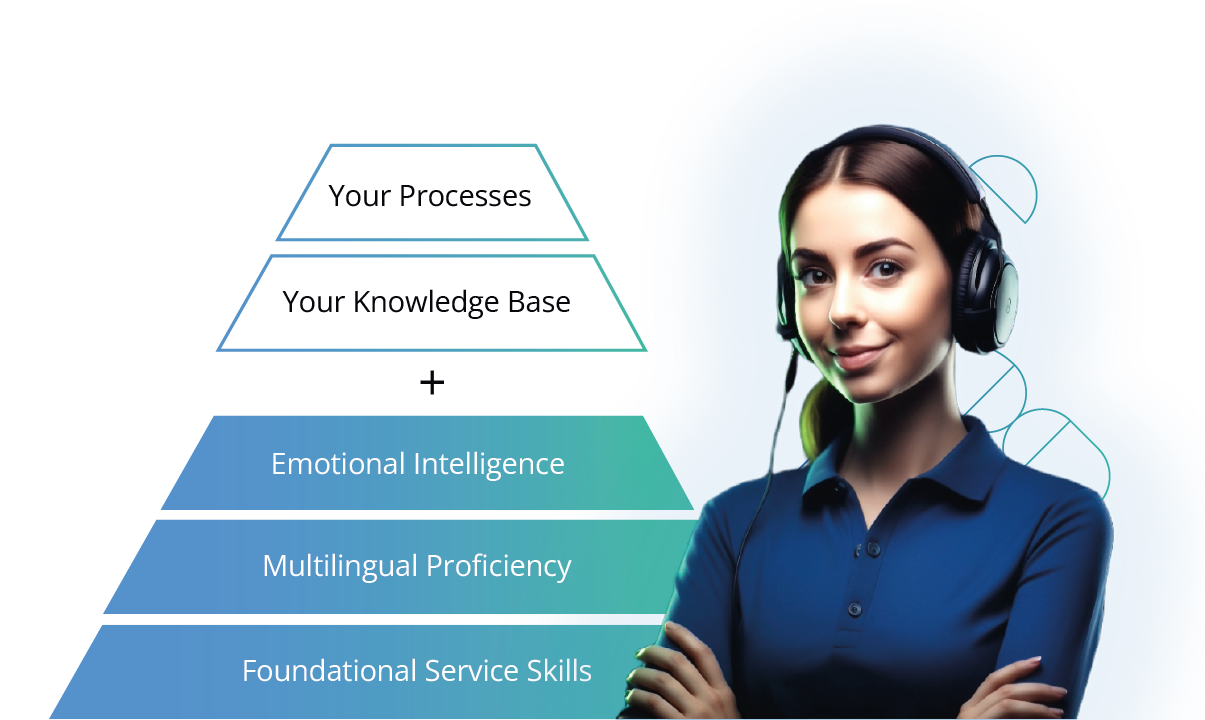

Humm Group, a financial services provider operating across the globe, faced challenges in maintaining high-quality customer experiences without overburdening their contact center team as demand for their services exploded.

To address this, they collaborated with Datacom and Cognigy to develop a Virtual Assistant that provides 24/7 customer support.

Understanding over 94% of customer intents, it handles tasks such as opening or closing accounts and explaining fees and charges. This has dramatically improved their resolution rate, decreased handling time and improved both the customer and agent experience.

Head of Workforce Management and Customer Improvement @Humm Group

I am truly impressed with the virtual assistant powered by Cognigy.AI. It has achieved a resolution rate of over 50% and our average handling time has significantly decreased, allowing us to provide faster and more efficient support to our customers by simultaneously increasing agent satisfaction.

Hear what they have to say

5.0

Reviewer Function:

Research and Development

Company Size:

30B + USD

Industry:

Transportation

Excellent Choice for Complex Conversational AI at Scale

"The use of Cognigy AI has allowed us to build several bots, use cases and integrations at scale for different companies at once. It is in use for four different legal entities of our international corporation, with several new ones to follow. Major advantages that we saw over other vendors...

5.0

Reviewer Function:

Software Development

Company Size:

<50M USD

Industry:

Healthcare and Biotech Industry

Feature-rich, and Stable Platform to Build a Sophisticated and Complex Product.

"Cognigy have provided exemplary support which is key to deploying sophisticated and complex solutions. What surprised me was that the platform is feature rich, but also robust - not a common combination in this space...

5.0

Reviewer Function:

Product Management

Company Size:

1B - 3B USD

Industry:

Telecommunication

Best Conversational AI Platform!

"Fantastic experience! Very responsive team and delivering new innovation quickly. The NLU is the best in the market and is extremely easy to build bots/virtual agents."

5.0

Reviewer Function:

Data and Analytics

Company Size:

30B + USD

Industry:

Retail

The Highly Interactive and Profitable Customer Interaction System

"Cognigy.AI; is a complete enterprise conversational platform that we use daily to automate our interaction with our customers. It's AI technology offers us Chatbots and virtual assistants that interact effectively and intelligently with clients and employees and reply to them in real-time. ...

5.0

Reviewer Function:

Customer Service and Support

Company Size:

500M - 1B USD

Industry:

Energy and Utilities

Bring Your Conversational AI Strategy To The Next Level With Less Code

We are using Cognigy since a year and have around 20 chatbots and 3 voicebots on the platform with above 1 million conversations. The product is ease to use, offers alot of prebuild integrations and is therefore a great product for enterprise usage, especially in a multi brand environment. The support acts fast and feature requests are always welcome and treated fast."

5.0

Reviewer Function:

Data and Analytics

Company Size:

1B - 3B USD

Industry:

Transportation

Most Flexible Conversation AI Platform

"The platform is a breeze to use. The set-up is done very quickly and it's all low code. Which gave us a lot more possibilities to speed up the process of creating flows and integrations with our back-end systems. They're very helpful in setting up the platform and helping to design the implementation plan."

The GARTNER PEER INSIGHTS Logo and GARTNER PEER INSIGHTS are trademarks and service marks of Gartner, Inc. and/or its affiliates and are used herein with permission. Gartner Peer Insights content consists of the opinions of individual end-users based on their own experiences with the vendors listed on the platform, should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product, or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose.

Conversational AI in banking and finance refers to the use of AI-powered AI agents who handle customer interactions. These virtual agents assist with various tasks, such as answering account-related queries, processing transactions, providing financial advice, fraud detection, and more. The goal is to deliver efficient, 24/7 support while improving customer experiences and reducing operational costs for banks and financial institutions.

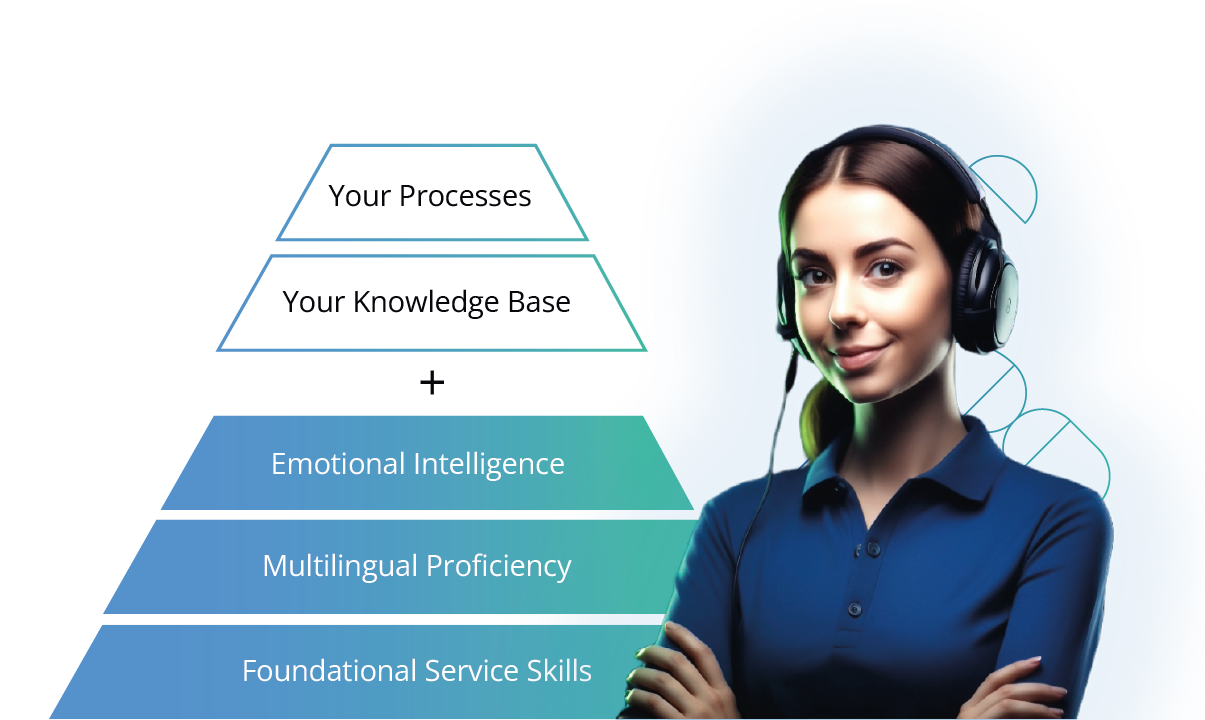

An AI Agent are human-like virtual agents based on Conversational AI and Generative AI designed to automate customer service interactions across chat and voice channels. AI Agents deliver instant, personalized support in over 100 languages and integrate seamlessly with enterprise systems. They are equipped with industry-specific skills, emotional intelligence, and the ability to understand and use a company’s service knowledge and processes. Additionally, AI Agents work alongside human agents, providing real-time assistance, knowledge lookups, next best actions, sentiment analysis, and more.

In banking and finance, an AI Agent handles customer service interactions by automating support tasks such as account inquiries, loan applications, fraud detection, and transaction processing. Chatbots in banking offer instant, multilingual assistance through chat or voice, providing personalized responses based on customer data and financial processes. AI Agents integrate with banking systems, pulling real-time information to address complex queries and assisting human agents with contextual knowledge and sentiment analysis during interactions. This seamless automation improves customer experience, reduces wait times, and increases operational efficiency while ensuring compliance with industry standards and regulations.

Conversational AI for customer service in banking and finance includes virtual banking assistants that help customers with routine inquiries like balance checks, fund transfers, and bill payments. AI Agents also guide customers through loan applications, do document intake, check eligibility, and provide real-time status updates. It enhances customer support by automating tasks such as password resets, credit card activation, and transaction disputes, significantly improving service efficiency.

Conversational AI in banking and finance is used for customer support, handling queries like balance checks, fund transfers, and transaction histories. It streamlines loan processing by guiding applicants through forms and providing real-time status updates. AI Agents detect and alert customers to potential fraud, offering swift action options. In addition, they help automate routine tasks such as password resets, card activations, and dispute resolutions, enhancing efficiency, reducing wait times, and improving the overall customer experience.

Conversational AI focuses on enabling machines to understand, process, and respond to human language in a natural, context-aware manner. It often uses predefined responses and rules-based models to manage interactions, typically found in chatbots or virtual assistants. Its primary goal is to automate and streamline specific tasks like customer service or inquiries. Generative AI, on the other hand, uses advanced algorithms like large language models (LLMs) to generate new content, such as text, images, or even responses, based on the input it receives. Unlike Conversational AI, it doesn't rely on predefined scripts and can create more flexible, diverse, and human-like responses. In summary, Conversational AI is task-oriented and structured, while Generative AI is more creative and open-ended, and cannot model processes or integrate with enterprise systems. That's why together, they are a powerful combination which brings the advantages of each while cancelling out their respective disadvantages.

The choice is yours